To Sell or to Hold

It is an interesting question whether one should sell real estate in a strong seller’s market or to hold in a profitable rental market. The current economic conditions characterized by massive government stimulus, low interest rates, and enormous post-lock down demand have created the highest average house prices in history and ever-increasing rents in many U.S. markets. This month’s inaugural newsletter is published by High Country Property Management, LLC and tackles the pros and cons of selling or holding in this market.

The U.S. median sales price for existing single family houses has surpassed pre-pandemic highs and exceeded them by 26%. There are many factors that contribute to this spike. Demand spurred by the lowest interest rate in history and a recovering global economy drives prices up. Furthermore, vaccines and COVID-fatigue are bolstering consumer confidence that the economy is looking optimistic. Also stocks have soared after recovering from the Great Recession and have reached stratospheric levels. Fears that the 12-year streak of a bull market may experience a correction are pushing investors to diversify. The fallout of the COVID-19 pandemic has crippled home builders during the shutdowns and has created supply chain shortages from wood and metal to computer chips and windows. Supply of houses could not keep up with demand even if builders had the desire. To sum it up, the conjunction of historically high demand and equally historic low supply have pushed prices to the highest level since the U.S. Census Bureau started tracking median house prices in 1940.

Graph 1: U.S. Median Sales Prices for Existing Houses Source:

In light of these staggering statistics, would it make sense to sell? Using this data in a simplistic manner, a seller today, say her name is Leilani, who bought just two years ago would realize a gross gain of 31%. The pro is obvious, take advantage of current conditions and realize the gains. Current market conditions may not hold and a correction may send house prices free falling like in the 2008 Great Recession. The argument that gold enthusiast Mike Maloney puts forth is one based on simple logic - buy low, sell high. When one asset class like real estate is historically high, get out of it and buy into a historically low asset class like businesses that shuttered during the Pandemic. Once the trend reverses, liquidate the business interests and get back into real estate. In theory, if this was done properly, an investor like Leilani could catapult her net worth rapidly. In practice, that is not so simple.

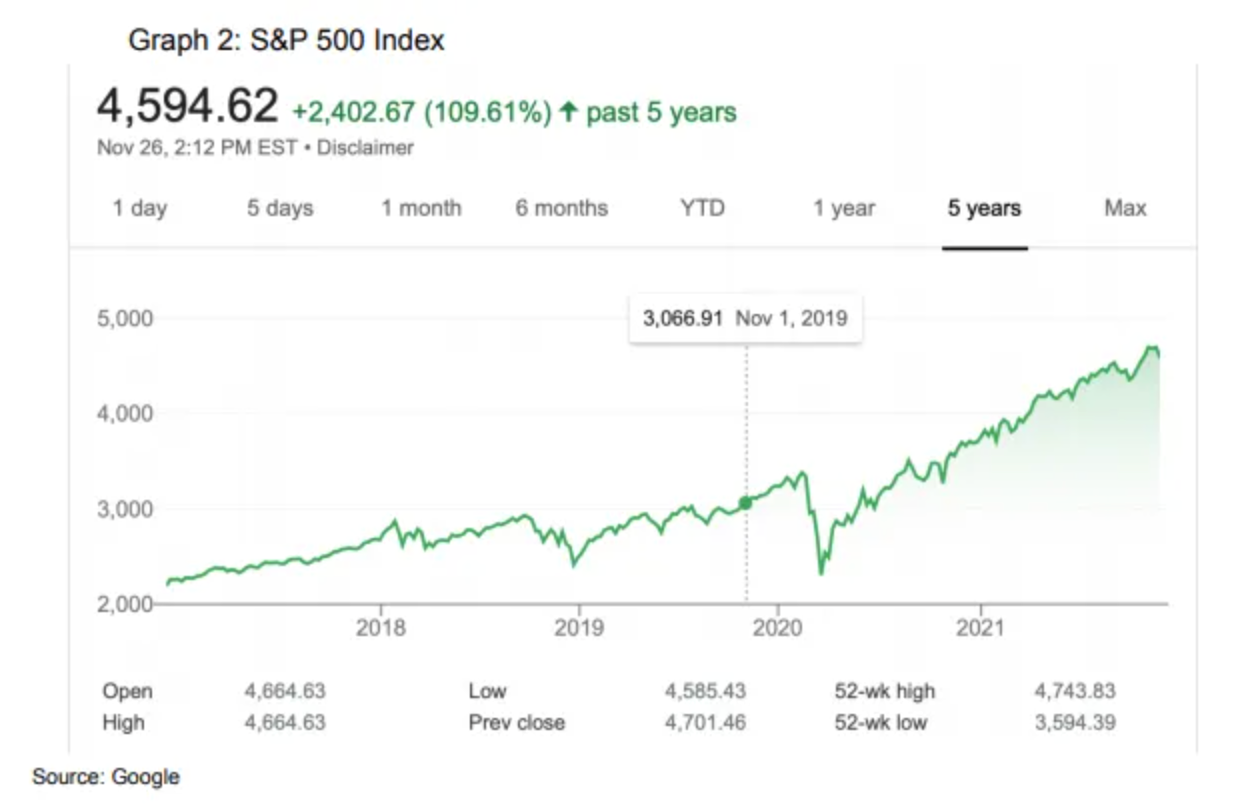

There are cons to selling. Let’s continue the example of a seller who bought two years ago. Using simple data from median house price graph, Leilani bought her house in November 2019 for $270,000. As part of her purchase she borrowed from the bank and paid closing costs and fees amounting to $8,000. Two years later, she sells the same house for $354,000, realizing a gross profit of $76,000, but she has to pay realtor fees of $21,000, repairs of $5,000, title and escrow fees of $2,000, and other related expenses of $3,000. This leaves her a net profit of $45,000. Although significantly reduced, this profit is not so bad and in numeric terms, the annual return on investment is approximately 6%. However, compared to the soaring stock indexes with annual return on investment of 25%, the real estate profit from the sale performs rather poorly (Graph 2).

Graph 2: S&P 500 Index

Furthermore, once the profit is realized, it would be important to have a new investment vehicle for the funds. Selling at historically high prices only to buy another property would defeat the purpose. Following Malony’s model of sell high and buy low, Leilani would seek another asset class that is currently undervalued. This may prove to be easier said than done when other assets like stocks, gold, and oil are all at high prices compared to two years ago. Without a new place to invest the earnings from the house sale, the profitability from the transaction would be further decimated.

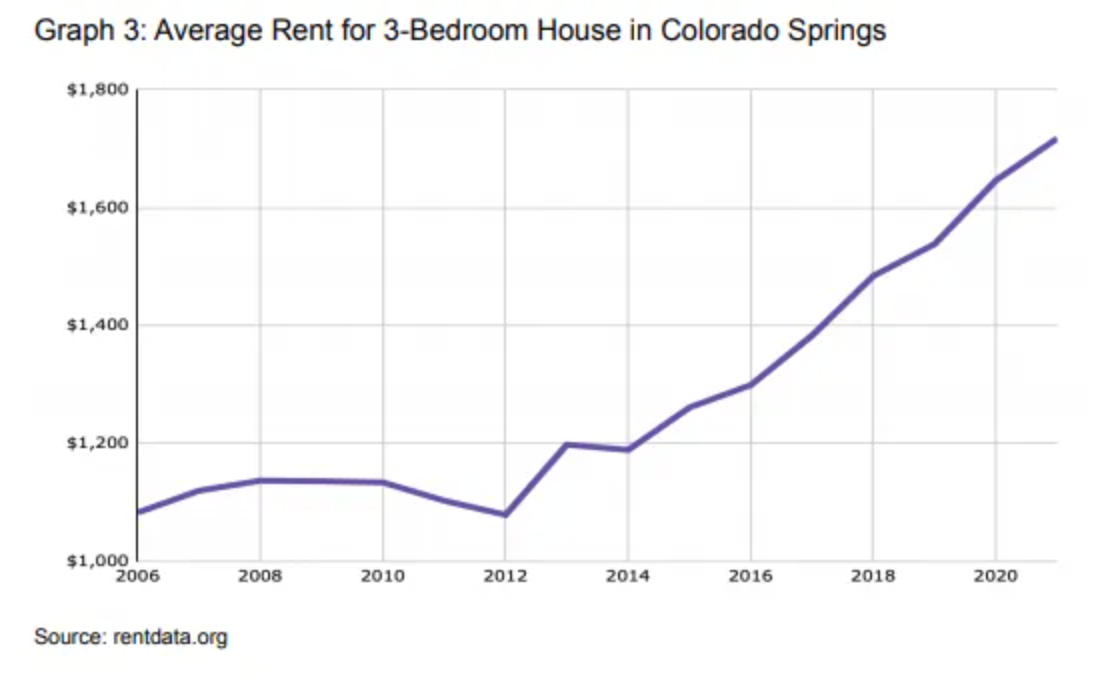

Alternately, the investor decides to forego selling and holds the property as a rental, what are the pros and cons for this scenario? Over the past two years, average rents have increased by 12% and the trend is clear on Graph 3. With the current market conditions presented in previous paragraphs, rents are likely to continue to increase. Continuing the example above, Leilani would realize a net return on investment of 4.2% in 2019, 7.9% in 2020, and 10.3% in 2021, while at the same time her house equity increased by $76,000. This equity build-up is unrealized, but there is a way to take advantage of it.

Graph 3: Average Rent for 3-Bedroom House in Colorado Springs

Without selling, the investor is able to continue the cashflow from rental income and use the equity. This sounds like she got the cake and gets to eat it, too, but in this case that is true. There are two relatively simple ways to unlock this equity - cash-out refinance or equity line of credit. In either case, she may be able to unlock at least $35,000 at a low interest rate to improve her liquidity or reinvest the funds.

Every investor’s situation is unique and the needs dictate which decision is more suitable. Selling in this high market allows the seller to realize the gains, but she should be cautious in assessing the costs that are not immediately apparent. It is also prudent that she has a plan to make the best use of the profits. Alternatively, holding in a high rental market increases the return on investment and still allows her to take advantage of the equity by unlocking it. However, a market downturn could result in a missed opportunity to sell high and buy low.

Thomas C. Co is a founding member of High Country Property Management, LLC ⧫ Website tlsquared.net ⧫ E-mail tlsquared@hotmail.com ⧫ Phone 719-321-6747

06/27/2014

Local Expertise, Professional Results

At TLSquared, we have decades of experience in nearly every facet of the real estate industry. We've seen the markets ebb and flow and understand how to not only make the most out of current situations but also how to properly forecast what is coming down the road. Our goal involves combining all of our resources and expertise into a set of top quality services that both property owners and prospective tenants won't be able to find anywhere else.

In our years of experience, the professionals at TLSquared have managed nearly every type of property that you can name. From homes to town homes to apartments to condominiums, we've seen it all and understand that each property has its own unique set of strengths and weaknesses. If you're a property owner, we have what it takes to match your home to the best possible tenant for a long term and stable form of passive income that you can rely on. For our tenants, we understand how to make your real estate dreams become a reality and put you in the home you've always hoped to live in as quickly and as efficiently as possible.